#No Debt Degree Campaign

Introduction

The American Dream says that we should all have the opportunity for a good life—to have a great job, own a home, a loving family, and achieve whatever we set our minds and energies to achieve. But the American Dream is just out of reach for many African American, Latinx, Asian Pacific Islander, and Native American women.

A college degree is often touted as a guaranteed pathway to the American Dream. The good news is women of color, especially Black women, are attending college at an all-time high rate and in some cases more than white youth and young adults.

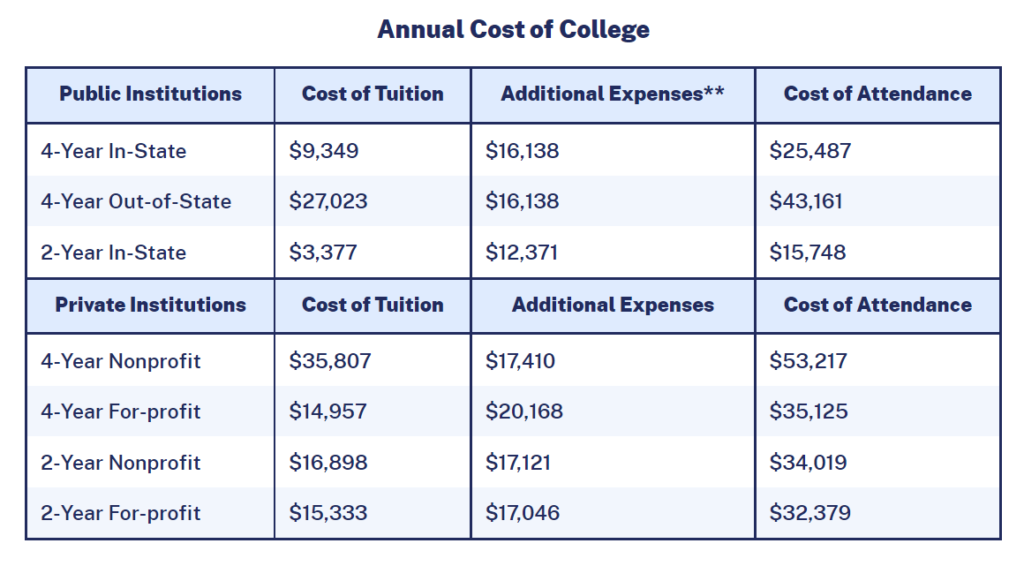

The bad news is the cost of attending college is $35,331 per student per year, including books, supplies, and daily living expenses. Since many families of color lack the financial resources to pay for college outright, women of color are forced to secure loans to pay for college. When they leave college, they have debt that compounds and the principal balance never seems to go down; while trying to meet current living expenses, often leaving little or nothing to save for the future.

Source: Hanson, Melanie. “Average Cost of College & Tuition” EducationData.org, March 29, 2022,

Recently, members of the U.S. Congress and the White House have floated the idea of forgiving $10,000 (on the low end) to the entire student loan balance. Many are wondering why loan forgiveness is difficult since both President Trump and President Biden have paused student loan payments during the pandemic. Conversely, some folks are very upset at the prospect of forgiving student loan debt and are working hard to stand in the way of any level of forgiveness.

WE CAN joins dozens of organizations calling for ALL college debt to be forgiven! This action would immediately improve the economic security of women of color enabling them to live better now and in the future.

Data (Why You Should Care)

From National Survey Shows Strong Support for Student Loan Cancellation Among Black Borrowers as Underfunding of HBCUs Compounds Students’ Financial Challenges United Negro College Fund, Center for Responsible Lending, and Center for Community Capital (UNC-Chapel Hill)

- HBCUs stepped up to support their students during COVID-19. Almost one in three (31%) Black students at HBCUs received emergency aid from their institution, compared to only one in five (21%) Black students at PWIs and even fewer (18%) white students.

- The $1.7 trillion student debt crisis impacts over 44 million families nationwide, and the burden of student loans falls particularly heavily on Black students because of historical and ongoing systemic racism.1 While Black families themselves typically have less wealth to draw upon to pay for college due to the racial wealth gap, Historically Black Colleges and Universities (HBCUs) have also been underfunded throughout their histories, compounding the challenges for HBCU students who face financial challenges at both the familial and institutional levels.2 These challenges often result in higher student debt burdens for students who attend HBCUs and relative difficulty in repayment for graduates.

- Black women receive less financial support from family during college compared to Black men, and they tend to struggle more than their male counterparts during repayment. While fewer than one in five (15%) Black men report receiving no financial assistance from family during college, more than one in three (35%) Black women report the same (Figure 1). And while fewer than half of all respondents in repayment (49%) report that they are currently making payments on their student loans, in part because of the COVID-19 payment pause, only 41% of Black women were making payments compared to 61% of Black men.

- Many current student borrowers report skipping meals because there wasn’t enough money for food. Among current students at PWIs, fewer than one in three current Black students report occasionally skipping meals (29%), compared to more than two in five (44%) current Black students at HBCUs.

From Quicksand: Borrowers of Color & the Student Debt Crisis ~ Center for Responsible Lending

African American women and Latinas had both the highest average student loan debt balances and were paid 61 and 53 cents, respectively, for every dollar earned by White men.

From Student Loan Debt by Gender ~ Investopedia

- At $41,466.05 on average, Black women owe the largest amount of debt, followed by White, Hispanic/Latinx, and Asian borrowers.

- Women of color who borrow money to pay for college are 12% more likely to have student loan debt than White women.

From Deeper in Debt: Women and Student Loans ~ American Association of University Women

Black women hold the highest amount of student loan debt of any racial or gender group. Typically owing $10,000 more than their peers.

From Student Debt and COVID-19 ~ Student Debt Crisis Center

One-third of women say that more than one-fourth of their monthly income goes toward student loan debt payments.

From How Black Women Experience Student Debt ~ The Education Trust

Twelve years after starting college, Black women owe 13% more than they borrowed, while white men, on average, have paid off 44% of their debt.

From Debt to Society The Case for Bold, Equitable Student Loan Cancellation and Reform ~ Dēmos

Twelve years post-college, white men had paid off 44% of their student loan balance while white women had paid off 28%. Within the same 12-year timeframe Black women saw their loan balances actually increasing by 13% on average due to the interest compounding on their debt.

From What Happens if Student Loan Debt is Canceled? ~EducationData.org

- Cancelling student loan debt may add up to 1.5 million new jobs.

- Student loan debt cancellation may lift up to 5.2 million American households out of poverty.

- Debt cancellation could potentially increase consumer spending by as much as 3.3%.

- Current debt cancellation plans would reduce the debt burden for 35 million Americans with federally-held student loan balances.

News Stories and Videos

Student Debt: Last Week Tonight with John Oliver

How U.S. Student Loans Became a $1.6 Trillion Crisis

What the Student Loan Payment Pause Has Meant to Black Women

What You Can Do!

ASAP

Write or Call (202-456-1111) President Biden and let him know how canceling student loan debt would help you.

As President Biden is considering what to do about student loan debt, he needs to hear from the American people who are struggling with debt. He needs to understand how compounding interest is hurting you now and negatively impacting your future.

Give an honest and clear example of how loan forgiveness would help you and your family.

Want More Information?

Contact WE CAN at info@womensequity.org to stay abreast of the #NoDebtDegree Campaign and other actions you can take to be a change agent in your community.